unlevered free cash flow dcf

While there are many types of Free Cash Flow in a standard DCF model you almost always use Unlevered Free Cash Flow UFCF also known as Free Cash Flow to Firm FCFF because it produces the most consistent results and does not depend on the companys capital structure. CFO focus on core business of.

When performing a discounted cash flow with levered free cash flow - you will calculate the equity value.

. Even if a company is profitable from a net income. Levered free cash flow is calculated as Net Income which already captures interest expense Depreciation Amortization - change in net working capital - capital expneditures - mandatory debt payments. This FCF shows the cash available after paying capex and all operational expenses including interest but not mandatory debt payments.

FCF - Includes interest but excludes mandatory debt payments amortization. Also referred to as unlevered free cash flow Free cash flow to equity FCFE. Its principal application is in valuation where a discounted cash flow DCF model DCF Model Training Free Guide A DCF model is a specific type of financial model used to value a business.

Free cash flow to the firm FCFF. Discounted cash flow is a widely used method of valuation often used for evaluating companies with strong projected future cash flow. With help of elasticity cash flow is managed.

This is the only method which assigns more importance to the future cash generation capacity of the company not the current cash flow. When building a DCF model using unlevered free cash flow the NPV that you arrive at is always the enterprise value EV Enterprise Value EV Enterprise Value or Firm Value is the entire value of a firm equal to its equity value plus net debt plus any minority interest of the business. Calculation finds that the present value of Company ABCs free cash flow FCF.

Cash flow that is available to the firm including bond investors if the company hypothetically has no debt. Cash flow from operation is cash generated from operational activities like manufacturing or selling goods and services etc. Unlevered Free Cash Flow.

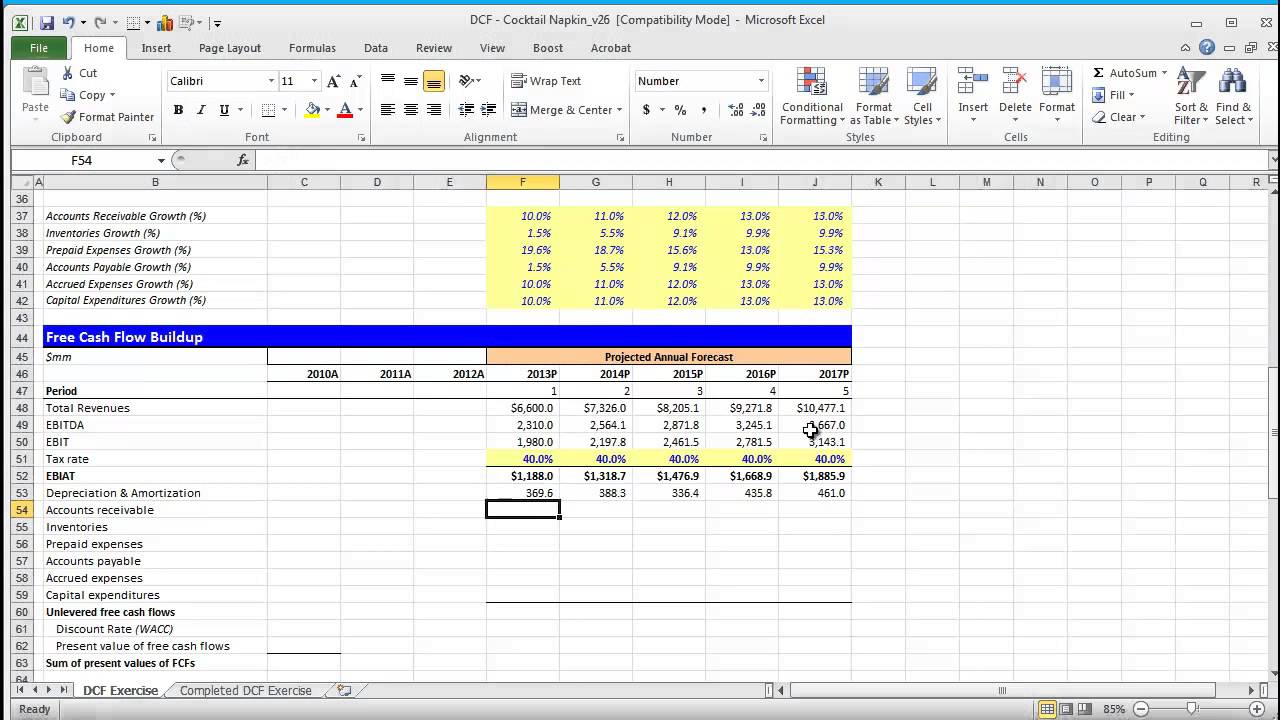

The model is simply a forecast of a companys unlevered free cash flow is built to determine the net present value NPV of a business. Our Discounted Cash Flow Valuation Template is designed to assist you through the journey of valuation. The amount of cash generated by a company that is available to stock investors.

Assuming you start with EBIT and go down the route of taking out taxes capex NWC and adding back DA I think of them like this. Adjusted Present Value Unlevered Firm Value NE. Cash is an important element for business it is required for the functioning of business some investor give more to cash flow statement than another financial statement.

This is what you need if youre looking to value the entire business or compare it with other. DCF Model Step 1.

The Ultimate Cash Flow Guide Understand Ebitda Cf Fcf Fcff In 2021 Cash Flow Statement Cash Flow Financial Analysis

Calculating Nike S Fair Value By Projecting Free Cash Flows Nike Drawing Nike Logo Wallpapers Symbol Drawing

Irr Project Finance Analysis Template Efinancialmodels Project Finance Spreadsheet Template Schedule Template

Discounted Cash Flow Dcf Valuation Model Excel Tutorials Cash Flow Excel Templates

Discounted Cash Flow Analysis Example Dcf Model Template In Excel In Stock Analysis Report Template 10 Professional Stock Analysis Report Template Templates

Discounted Cash Flow Dcf Excel Model Template Cash Flow Cash Flow Statement Financial Charts

Discounted Cash Flow Valuation Excel Templates Cash Flow Statement Cash Flow

Financial Modeling Quick Lesson Building A Discounted Cash Flow Dcf Model Part 1 Financial Modeling Cash Flow Financial

Discounted Cash Flow Dcf Excel Model Template Cash Flow Cash Flow Statement Financial Charts